The goods and services state and local governments provide are largely determined by the needs and priorities of the communities they serve. Funding for these programs is transferred down from the federal level to the state or municipal level, depending on which jurisdiction administers the services.

For many residents, it isn’t clear what goods and services their local government provides. This information is vital to the community because it not only lets them know what programs are available, but also creates transparency into who is responsible for maintaining and improving essential public services and infrastructure.

To clarify the sometimes murky world of local government expenditures, we put together a list of the most common goods, services, and programs most local governments provide their communities.

What Goods and Services Do Local Governments Provide?

Most state and local government budgets allocate funds to seven spending categories:

1. Hospitals and Healthcare

Expenditures in this category include public and community health programs, government-owned hospitals, government payments for private hospitals, and some Medicaid spending.

2. Public Welfare

Most Medicaid spending falls into this category. It also includes cash assistance through programs like Temporary Assistance for Needy Families and Supplemental Security Income.

3. Housing and Community Development

This category includes public housing and rental assistance, homeownership programs, and expenditures for the construction, operation, and support of housing, redevelopment, and revitalization projects.

4. Elementary and Secondary Education

Expenditures in this category include not only the operation, maintenance, and construction of public schools, but also spending on programs provided through the school system. A few examples are libraries, school lunches, pre-kindergarten programs, technical-vocational training, and guidance counseling.

5. Higher Education

Local government budgets separate higher education spending from elementary and secondary education. Higher education expenditures comprise the construction, operation, and maintenance of public community colleges and universities, including law and medical schools.

6. Highways and Roads

This category includes the construction, operation, and maintenance of streets, roads, sidewalks, bridges, standard highways, toll roads, and other road-related structures.

7. Criminal Justice

The criminal justice category is generally broken down into three subcategories:

- Police expenditures: Police officers, sheriffs, state highway patrols, and other public safety departments

- Corrections expenditures: The construction, operation, and maintenance of jails and prisons, as well as probation officers and parole boards

- Court expenditures: Civil and criminal courts, prosecuting and district attorneys, public defenders, witness fees, law libraries, and wills

Accounting for Shifting Priorities

Although local government budgets are neatly organized into specific categories, these categories don’t tell us how those programs and services address community needs.

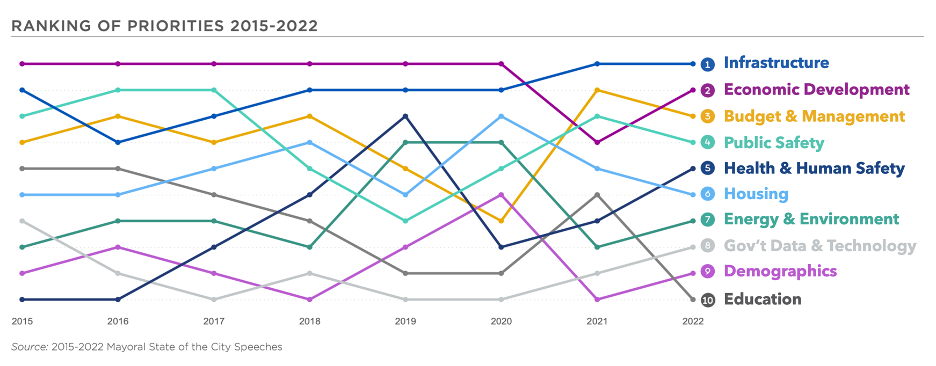

Community priorities shift over time, and as they change, government budgets need to be adjusted to ensure that the highest-priority programs have the resources they need and underused services aren’t overfunded.

See shifting priorities in this chart reflects local government data from 2015 to 2022 from the National League of Cities (NLC) “State of the Cities” report.

Unlike the traditional, line-item-focused approach to government budgeting, programmatic and priority-based budgeting allows local governments to pivot quickly and redistribute funding to the programs and services that need it most.

Additionally, local government budgets are most impactful when approached as a strategic plan rather than a continuation of the previous year’s budget. This requires input from the community, accountability for program implementation, data-back after-action reviews, and open communication between government leaders and the communities they serve.

Budgeting Software Helps Local Governments Align Funding with Priorities

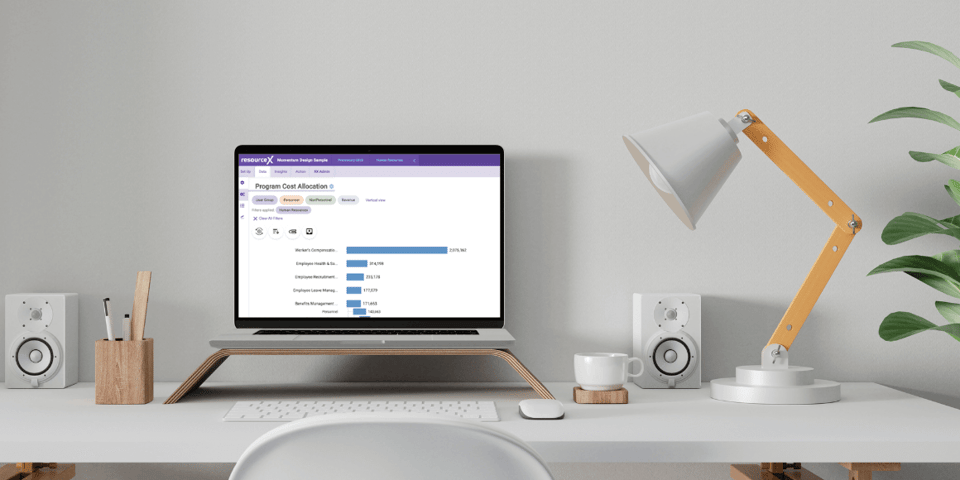

If you are new to priority-based budgeting or looking for ways to make your budgeting processes more strategic, government budgeting software can help.

The right budgeting software solution helps align budget allocations with community priorities by extrapolating line items to determine how they are utilized across departments and programs.

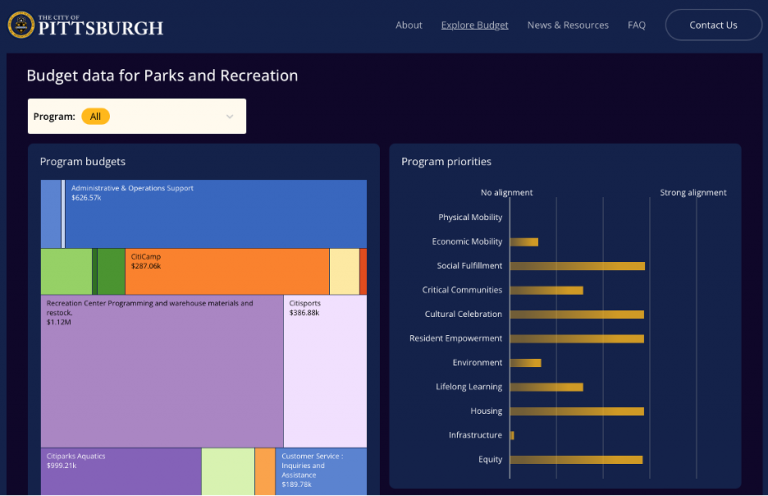

This example illustrates parks and recreation program budgets working to align with program priorities.

With a broader, more holistic view of the budget, finance teams can make data-backed decisions, improve planning and forecasting, and understand a program's true cost and why funds are allocated to specific services.

Priority-Based Budgeting Success Stories

Many of the programs and services local governments provide are similar, no matter where you are located. However, several cities that have adopted priority-based budgeting are affecting measurable and lasting change by focusing funding on the right programs and services.

Download the “ResourceX 2021 Annual Impact Report” to read their success stories and discover how implementing priority-based budgeting can improve the communities you support.